69VN – Nhà Cái Trực Tuyến Uy Tín Số #1

Nhà cái 69VN - Nhà cái đẳng cấp nhất Việt Nam

69VN là một trong những nhà cái hàng đầu với sự hợp pháp và uy tín được xác nhận bởi Costa Rica. 69VN tự hào sở hữu một công ty trò chơi được đăng ký đầy đủ theo pháp luật tại đất nước này, cam kết tuân thủ nghiêm ngặt các quy định của hiệp ước cờ bạc chính phủ Costa Rica. 69VN không ngừng đổi mới và cải tiến để mang đến cho người chơi những trải nghiệm độc đáo và thú vị nhất. Được hỗ trợ bởi đội ngũ sáng tạo đầy nhiệt huyết, 69VN phát triển các sản phẩm trò chơi đa dạng và độc đáo, đảm bảo mang lại sự hài lòng tối đa cho mỗi người chơi của 69VN.. abc88 bk8 69vn 13Win.com 68 Game Bài 6FF 68 Game Bài qq88 du88 https://98win.free/ rr88 build link Au88 Link 33Win Link PG66 Link 32WIN GA6789 DR88 https://ga6789.com/ https://ok365ok.net/ https://69vnn.ninja/ 6ff 28bet nhà cái DAGA ALO789 E2BET AX88 789p.green trang chủ 789p VMAX Tải GO99

Tại sao khách hàng lại chọn 69VN?

Sứ mệnh hàng đầu của 69VN.COM là cung cấp những sản phẩm giải trí hấp dẫn, dịch vụ chu đáo và chất lượng cao, đem đến trải nghiệm đáng nhớ và an toàn cho người chơi yêu thích cá cược, đánh bài casino trực tuyến. 69VN luôn mong muốn tạo ra một môi trường cá cược lành mạnh, nơi mà mỗi người chơi đều có cơ hội để thể hiện khả năng của mình. Với mục tiêu này, 69VN thiết lập các quy định cực kỳ nghiêm ngặt để đảm bảo không có hành vi gian lận xảy ra. Đồng thời, điều này cũng giúp cho các trận đấu diễn ra một cách công bằng và minh bạch nhất có thể.

Đối tác khác: Sunwin9.dev, Lu88 68 game bài https://f168.studio/ King88 https://j88.ad/ https://abc8com.info/ https://f168.com.co/ https://gk88.watch/ kubet 33win https://abc8.discount/ Kubet daga https://u888vi.club/ 6686 bóng đá Hubet https://bsport.now/

Bảo mật và an toàn Nhà cái 69VN rất chú trọng đến vấn đề bảo mật và an toàn thông tin của người chơi. 69VN áp dụng các biện pháp chặt chẽ để đảm bảo rằng mọi hoạt động trong trò chơi đều được bảo vệ và không bị xâm phạm. Đầu tiên, 69VN sử dụng công nghệ mã hóa SSL (Secure Socket Layer) tiên tiến để đảm bảo rằng thông tin cá nhân của người dùng như tên, địa chỉ và thông tin tài khoản không bị lộ ra ngoài. Điều này giúp người chơi cảm thấy yên tâm khi tham gia các hoạt động cá cược, chơi bài trên 69VN. Hệ thống bảo mật của 69VN được thiết kế để ngăn chặn các hoạt động gian lận và tấn công mạng, 69VN cũng đầu tư mạnh mẽ vào công nghệ và các chuyên gia bảo mật để đảm bảo rằng dữ liệu của người chơi luôn an toàn và không bị đánh cắp. s666 com trang chủ U888 Ok9 com sin88 qq88 casino 13win 888b VMAX

Đa dạng các trò chơi đẳng cấp Nhà cái 69VN là nơi tập hợp đa dạng các trò chơi đẳng cấp, mang đến cho người chơi trải nghiệm thú vị và đầy hấp dẫn. Với sự lựa chọn phong phú từ những trò chơi kinh điển như Baccarat, Roulette, tiến lên, mậu binh, phỏm,… đến những tựa game mới lạ và hấp dẫn như Slot game, bầu cua, tài xỉu, Poker,… 69VN cam kết mang đến sự hài lòng và niềm vui cho mỗi người chơi bằng công nghệ hiện đại và giao diện thân thiện giúp người chơi dễ dàng tiếp cận và tham gia vào các trò chơi một cách thuận tiện nhất. abc8 ok9 qq88.to U888 com

Với sứ mệnh mang đến không gian giải trí an toàn, công bằng và chuyên nghiệp, 69VN và shbet luôn là lựa chọn hàng đầu của các tín đồ yêu thích trực tuyến. Để trải nghiệm của người chơi hoàn hảo nhất 69VN còn đầu tư vào hệ thống của mình với những trò chơi không những hay mà còn có hình ảnh được chăm chút đẹp mắt và âm thanh vô cùng sống động.

Đối tác: F168 Nhà cái Uy Tín 88CLB https://789winonline.tech/ kubet f168 kubet77 https://8kbetna.com/ link qq88 https://888be8.com/ 33win cakhia TV 789win https://qq88.gd/ 98win

Nạp rút nhanh chóng Nhà cái Uy Tín U888 là địa chỉ đáng tin cậy cho những người chơi đam mê trực tuyến không chỉ vì các trò chơi đa dạng mà còn vì hệ thống nạp rút nhanh chóng và tiện lợi. Với sự hỗ trợ của nhiều phương thức thanh toán phổ biến như chuyển khoản ngân hàng, ví điện tử và các thẻ cào điện thoại, người chơi có thể thực hiện giao dịch một cách dễ dàng chỉ trong vài bước đơn giản tại OK9 link qq88 8kbet.com 789bet.com

Các bước nạp tiền vào tài khoản game bài dễ dàng

- Bước 1: Sau khi đăng nhập vào 69VN.COM, các thành viên bấm vào nạp tiền.

- Bước 2: Chọn cổng nạp tiền phù hợp với cách thức chuyển tiền của mình.

- Bước 3: Chọn ngân hàng nạp tiền, nhập số điểm nạp và tiếp tục.

- Bước 4: Thực hiện chuyển tiền qua thông tin ngân hàng được hiển thị tại 69VN.COM .

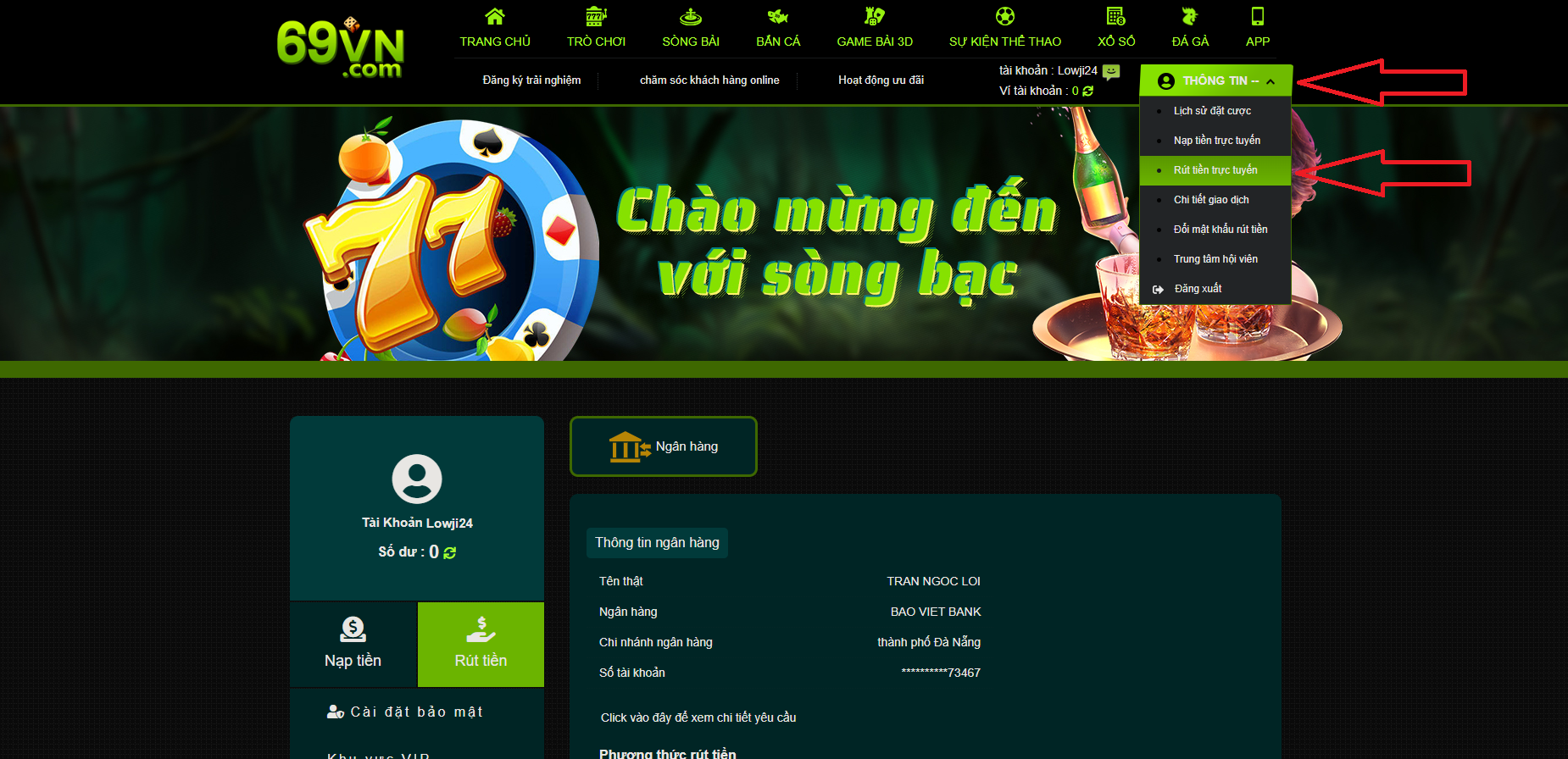

Các bước rút tiền từ tài khoản

- Bước 1: Sau khi đăng nhập vào 69VN.COM, các thành viên bấm rút tiền.

- Bước 2: Nhập số điểm cần rút (1 điểm = 1000 VND, số dư phải lớn hơn hoặc bằng số điểm rút yêu cầu).

- Bước 3: Chọn gửi đi và đợi tiền về với ngân hàng đã liên kết.

Đặc biệt, các giao dịch được xử lý nhanh chóng, giúp người chơi có thể trải nghiệm game mà không bị gián đoạn và bất kỳ rắc rối nào. Đây là một trong những yếu tố quan trọng giúp 69VN nổi bật và được đánh giá cao trong cộng đồng người chơi trực tuyến hiện nay. Đội ngũ hỗ trợ chuyên nghiệp và nhanh chóng Đội ngũ hỗ trợ của Nhà cái 69VN không chỉ chuyên nghiệp mà còn nổi bật với ưu điểm nhanh chóng và thân thiện. Với đội ngũ nhân viên được đào tạo kỹ lưỡng, 69VN cam kết cung cấp dịch vụ chăm sóc khách hàng tốt nhất, luôn sẵn sàng giải đáp mọi thắc mắc và hỗ trợ người chơi mọi lúc mọi nơi. Bất kể là vấn đề về giao dịch, kỹ thuật hay các yêu cầu đặc biệt, người chơi có thể hoàn toàn yên tâm với sự hỗ trợ chu đáo và nhanh nhạy từ đội ngũ chuyên viên của 69VN. Điều này giúp tạo nên một môi trường chơi game trực tuyến an toàn và tin cậy, nơi mà người chơi luôn có thể cảm thấy được sự quan tâm và sự hỗ trợ chuyên nghiệp hàng đầu.

69VN – Trang chủ nhà cái nhiều ưu đãi và khuyến mãi

69VN không chỉ là một Nhà cái uy tín và đa dạng trò chơi, mà còn nổi bật với những ưu đãi và khuyến mãi hấp dẫn, mang đến cho người chơi trải nghiệm thú vị và đầy bất ngờ. Tại 69VN, người chơi không chỉ được thưởng thức những trò chơi đa dạng, hấp dẫn mà còn được tận hưởng các ưu đãi đặc biệt từ các chương trình khuyến mãi nhiều và hấp dẫn.

Đầu tiên là chương trình khuyến mãi đăng ký mới. Kể từ bây giờ, sau khi đăng ký thành viên mới tại 69VN, liên kết thẻ ngân hàng, và nạp 69K lần đầu tiên, bạn có thể nhận được 69K tiền thưởng, giới hạn trò chơi Nổ hũ, bắn cá!. Ngoài ra, 69VN cũng thường xuyên tổ chức các sự kiện và chương trình thưởng điểm như:

- Vào ngày hội viên của 69VN, tiền thưởng sẽ được tặng ngẫu nhiên, có thể lên đến 1000 tỷ đồng với phạm vi áp dụng không giới hạn trò chơi. Đặt cược càng nhiều, cơ hội nhận thưởng càng lớn. Trong ngày hội viên chỉ cần đăng nhập đúng giờ có thể nhận được phần thưởng.

- Vào ngày sinh nhật 69VN tặng ngay phần quà SN tặng 100% giá trị đơn nạp không giới hạn để bạn có thể niềm vui trong ngày quan trọng của mình.

- Tất cả các thành viên mới và cũ của 69VN khi tham gia đặt cược Trò chơi Nổ hũ, Bắn Cá và Thể Thao, từ Thứ hai đến Chủ nhật mỗi tuần với số tiền đặt cược hợp lệ từ 2.000 điểm trở lên đều có thể nhận được điểm tích lũy tuần.

Đây nơi người chơi có thể tích lũy điểm thưởng và đổi lấy các phần quà giá trị như tiền thưởng, lượt quay miễn phí hoặc các phần thưởng hấp dẫn khác.

Hơn nữa, chính sách hoàn trả và chiết khấu đặc biệt dành cho các thành viên VIP cũng là hệ thống được yêu thích tại 69VN. Những thành viên trung thành được hưởng những ưu đãi độc quyền, bao gồm các chương trình thưởng doanh thu lên tới 0.3% tổng tiền đặt cược, quản lý tài khoản cá nhân chuyên nghiệp và hỗ trợ ưu tiên từ đội ngũ chăm sóc khách hàng. Đây là chương trình mà 69VN tri ân tới những người chơi luôn đồng hành với 69VN trong thời gian dài.

Đối tác khác: f168 , AB77 f168, ok9 nhà cái Bj88 OK365 Alo789

Hãy đến với 69VN ngay hôm nay để khám phá thế giới các trò chơi đa dạng và trải nghiệm những ưu đãi hấp dẫn không thể bỏ lỡ! Đăng ký ngay để nhận các phần thưởng đặc biệt và tham gia vào những sự kiện giải trí độc đáo. Cùng 69VN, bạn không chỉ chơi game mà còn có cơ hội thắng lớn và thưởng thức một môi trường chơi game an toàn, chuyên nghiệp. Chào đón bạn đến với trải nghiệm tuyệt vời, chỉ có tại 69VN!